Pension cola calculator

No COLA has been granted since 2002. The Consumer Price Index for All Urban Consumers CPI-U was unchanged in July on a seasonally adjusted basis after rising 13 in June.

Early Retirement The Western Conference Of Teamsters Pension Trust

Roth IRA calculator.

. A COLA is a benefit adjustment meant to offset inflation but may not be based on the money available to fund payments. PERS and TRS Plan 1 members use this Excel calculator to compare your benefit with and without the optional COLA. CSRS was established on January 1 1920 and its a classic pension plan similar to those established during the same time period among labor unions and large companies.

All military retirements are protected from inflation by an annual Cost of Living Adjustment COLA based on changes in the Consumer Price Index CPI as measured by the Department of Labor. Under federal law the cost-of-living adjustments to VAs compensation and pension rates are the same percentage as for Social Security benefits. Cost-of-Living increases are not automatically granted.

College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan. A modified formula is used to calculate your benefit amount resulting in a lower Social Security benefit. Plan 1 Optional COLA calculator.

This tool is designed to calculate relatively simple annuity factors for users who are accustomed to making actuarial. Campa Cola was conceived by Pure Drinks Group - which originally was the bottler and distributor of Coca-Cola - after Coke was asked to leave India in the late 1970s. The MSERS is a contributory defined benefit system governed by Massachusetts General Law Chapter 32.

This is a major factor because without a COLA you can lose considerable. It along with soft drink brands developed by Parle - Thums Up Gold Spot and Limca - were dominating the market. The Society of Actuaries SOA developed the Annuity Factor Calculator to calculate an annuity factor using user-selected annuity forms mortality tables and projection scales commonly used for defined benefit pension plans in the United States or Canada.

Early Retirement Bump in Pension. There is an IRS withholding calculator available through your online account. By law legislators the Pennsylvania General Assembly must enact legislation granting cost-of- living increases.

Complicating the analysis is whether income from your pension has a cost-of-living adjustment COLA which can increase your payments to help keep up with inflation. A non-profit agency known as Gold Star Mothers has worked on behalf of Gold Star families since 1928. Unlike some states the WRS does not give guaranteed COLAs to retirees.

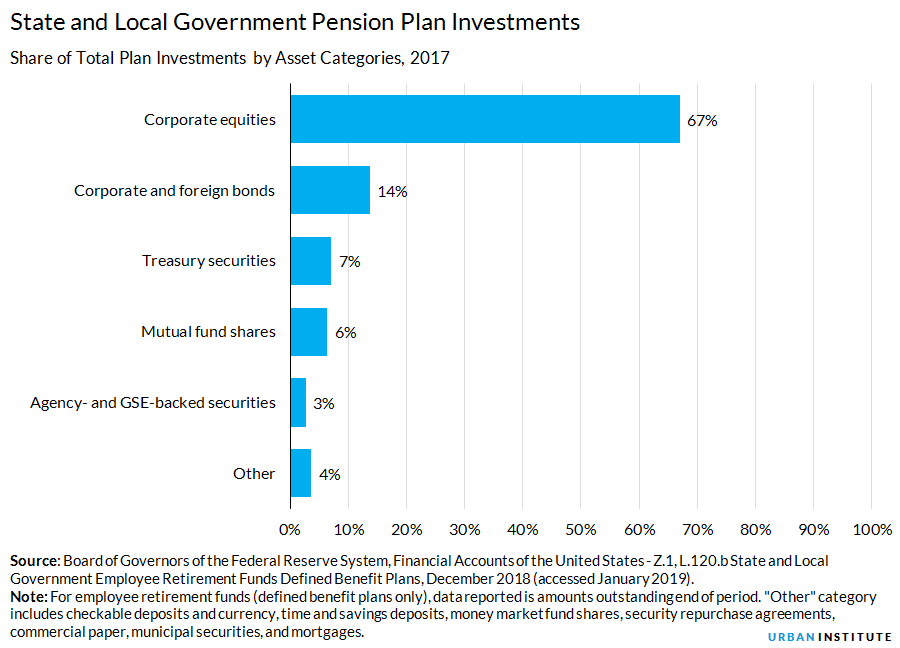

The July CPI-W 292219 increased over the last 12 months by 91Since July 2021 the all items index increased 85 before seasonal adjustment. 75728963 Benefits paid to retirees and their beneficiaries over the last fiscal year. The public pension system could see its largest single-year decline in its funded ratio since the 2008 Great Recession with the aggregate funded ratio dropping from 848 to 779 and unfunded.

Build a Retirement Plan. Since the 1980s however pension plans have been gradually phased out and replaced with. Employees contribute a certain percentage of their pay.

Generally it is the norm to gradually increase pension payout amounts based on the COLA to keep up with inflation. The windfall elimination provision affects how the amount of your retirement or disability benefits is calculated if you receive a pension from work where Social Security taxes were not taken out of your pay. See these tips for finding and using a retirement calculator with pension.

When these COLAs start depends at what age a FERS employee retires. 2023 COLA Cost-of-Living Adjustments Increase Watch. A members start date with the City of Chicago determines that persons Tier for the purpose of retirement benefits.

Gold Star Family Resources. Because important pension-related decisions made before retirement cannot be reversed employees may need to consider them carefully. The system provides retirement disability survivor and death benefits to its members and their beneficiaries.

SPIAs have been sold in the United States for hundreds of years and are still the best personal pension plan for lifetime income if you need those payments to start immediately. Pension plans have a history dating back to 1875 when the first corporate pension plan was established in the US. If the CPI-W triggers a COLA this year the COLA becomes effective in December 2022 and is payable in January 2023.

At the American Express Company. If a FERS employee retires before age 62 then the FERS annuitant is eligible to receive his or her first COLA in January of the year following the year the annuitant becomes age 62. WRS annuity adjustments are based on the investment returns of WRS trust funds and actuarial factors like death rates.

Those who have worked in government jobs for over ten years may receive the MRA10 pension. COLAs are not granted for survivor annuitants as this would require a change in the Pennsylvania Constitution. SPIAs are still the foundation of most retirement income plans or retirement plans that need a guaranteed income floor in addition to Social Security.

Social Security payments and 2023 VA disability rates always reflect the benefits due for the preceding month. Cost-of-Living Adjustment COLA Information for 2022. Retirement plan income calculator.

Periodically VA makes cost-of-living adjustments COLAs to VA compensation and pension benefits to ensure that the purchasing power of VA benefits is not eroded by inflation. Free financial counseling services for beneficiaries of SGLI FSGLI and TSGLI. The COLA is equivalent to that given to military retirees and Social Security recipients.

Social Security and Supplemental Security Income SSI benefits for approximately 70 million Americans will increase 59 percent in 2022. 2022 COLA CPI Summary. The City of El Paso Employees Retirement Trust pays millions of dollars in pension payments to over 3500 City retirees and their beneficiaries.

The 59 percent cost-of-living adjustment COLA will begin with benefits payable to more than 64 million Social Security beneficiaries in January 2022. The Social Security benefit amount after applying the COLA is rounded down to the next lowest dime. Surging prices could push next years Social Security COLA to 10.

Campa Colas slogan was The Great Indian Taste. Gold Star Mothers have a mission to educate remember and inspire. A member who started working for the CPD prior to January 1 2011 is considered a Tier 1 participant and a member who started working for the CPD on or after January 1 2011 is considered a Tier 2 participant in the pension fund pursuant to Article 5 of.

FERS Early Retirement Bumps In Pension A FERS early retirement bump will not increase your pension amount. 2 min read Aug 12 2022. The MSRB administers the Massachusetts State Employees Retirement System MSERS for state employees and certain other employees of public entities.

This is because your FERS annuity will not increase if you wait until the age of 62. Pension policies can vary with different organizations. Whether you have a state federal or private retirement pension start now.

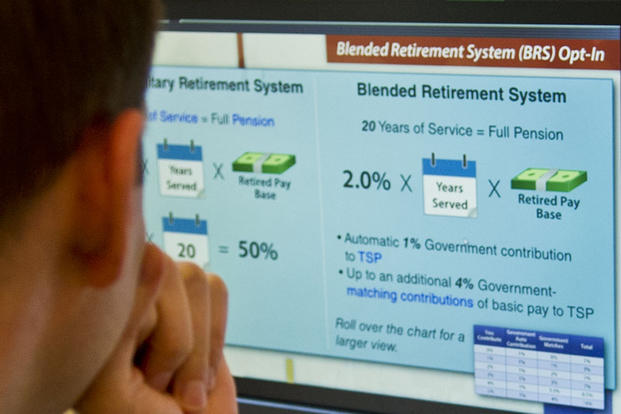

Under the Final Pay High-36 and BRS retirement plans the annual COLA is equal to the percentage increase in the CPI year over year. The NewRetirement Planner allows you to specify if your pension will adjust with the Cost of Living and at what rate. This assumes there is a COLA in a particular year.

Policy And Legal Issues Pension Rights Center

Best Practices For Cost Of Living Adjustment Designs In Public Pension Systems Reason Foundation

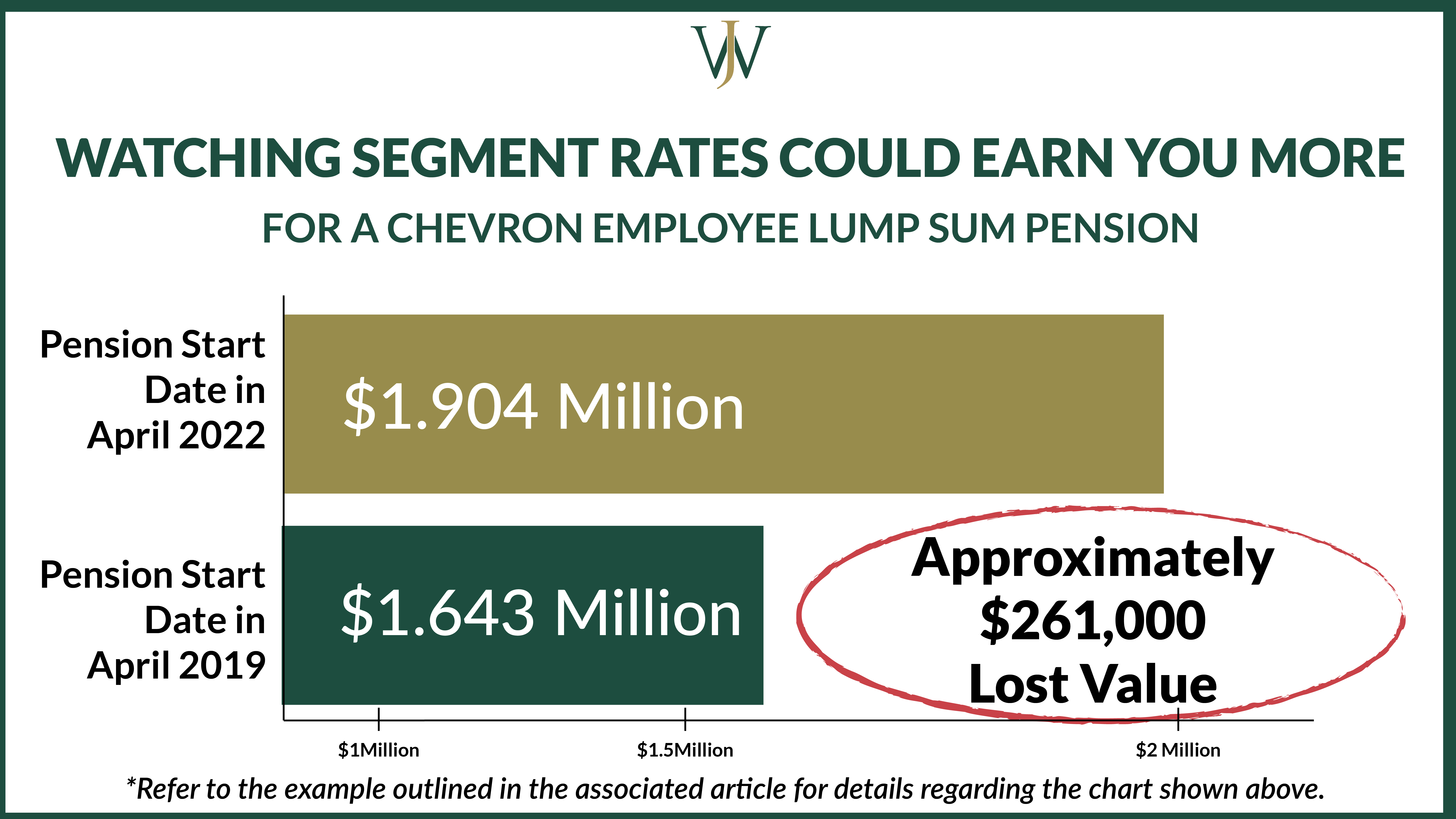

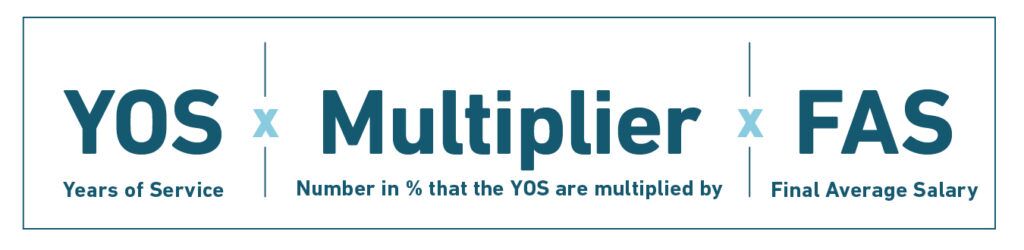

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Public Pensions In California Public Policy Institute Of California

What Is The Average Pension Of A Federal Employee Government Deal Funding

The Blended Retirement System Explained Military Com

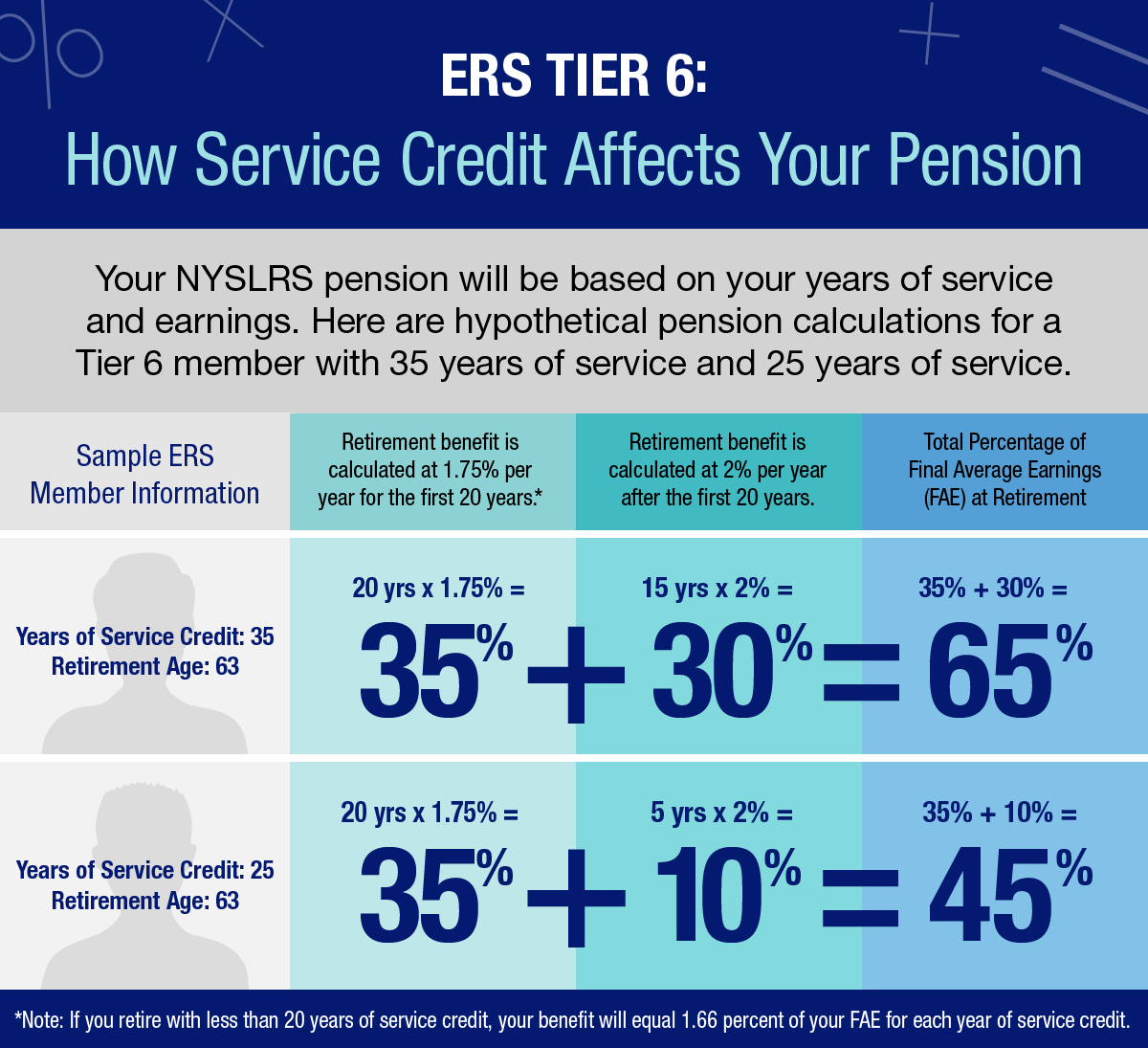

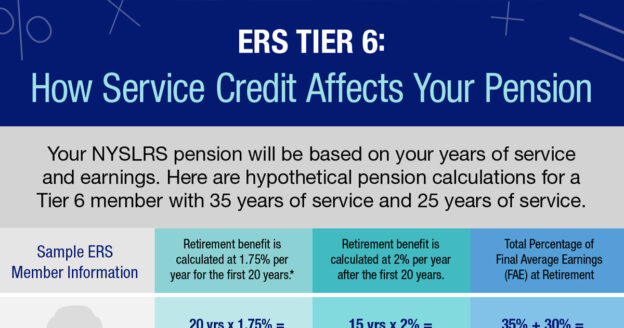

Ers Tier 6 Benefits A Closer Look New York Retirement News

Calculate Present Value Of Military Pension Us Vetwealth Career Military High Income Veterans

Service

Estimate Your Benefits Arizona State Retirement System

How To Calculate Net Present Value Of A Future Pension

Ers Tier 6 Benefits A Closer Look New York Retirement News

Pension Basics How Pension Benefits Are Calculated

Cost Of Living Adjustments Cola Los Angeles City Employees Retirement System

Sdcers Cost Of Living Adjustment Cola For Fiscal Year 2023

Why Optimizing Your Bp Pension Comes Down To Timing

Pension Massachusetts Laborers Benefit Funds